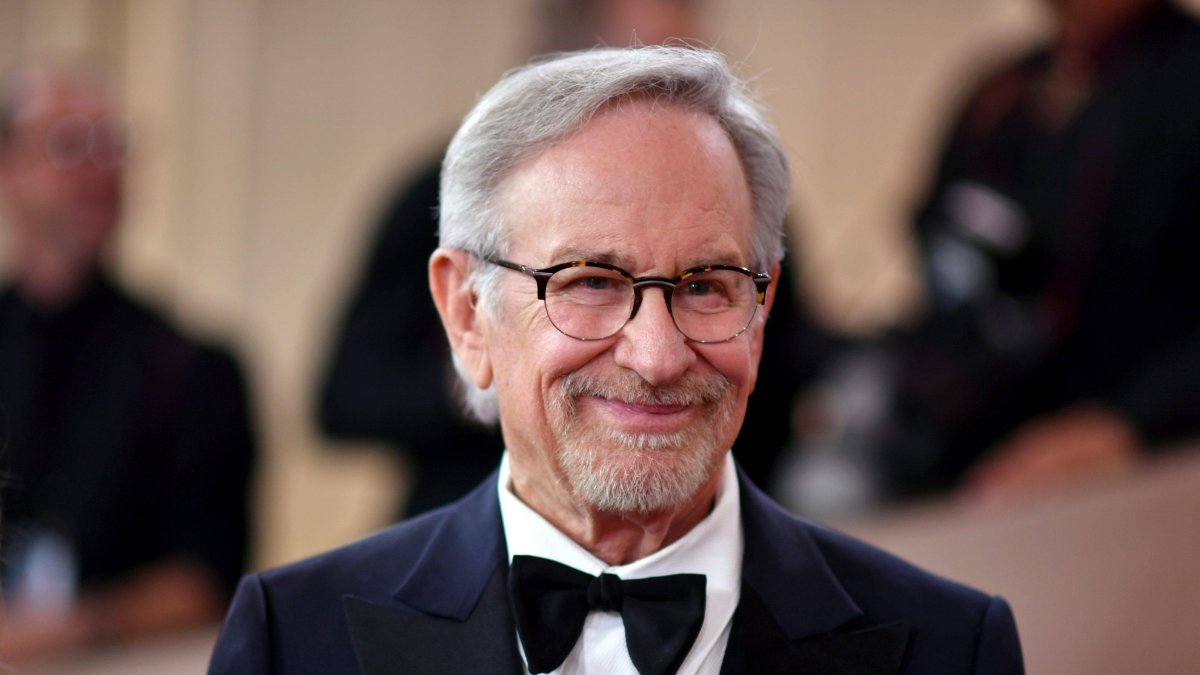

Billionaire flight: Steven Spielberg leaves California as campaign for Billionaire Tax Act gathers momentum

"The billionaire class no longer sees itself as part of American society," argued Senator Bernie Sanders, a proponent of the measure. Although Spielberg did not comment specifically, several businesspeople spoke out against the measure, some even moving.

Steven Spielberg moves to New York City

Steven Spielberg is leaving California for New York. The legendary director of such hits as "E.T." and "Jurassic Park" became the latest Hollywood star to leave The Golden State in recent months. Not only did he buy a property in an exclusive Manhattan building, but also his production company, Amblin Entertainment, opened an office in the city.

"Steven’s move to the East Coast is both long-planned and driven purely by his and Kate Capshaw’s desire to be closer to their New York based children and grandchildren," a spokeswoman for the director and producer maintained in words reported by The Los Angeles Times.

The Californian newspaper made it explicit that the spokeswoman declined to answer questions about a controversial estate tax that voters could approve at the polls in November.

If passed, the Billionaires Tax Act of 2026 would levy a one-time 5% tax on individual fortunes exceeding $1 billion. Proponents of the measure claim it will provide funds to plug state health care deficiencies, while detractors point out that it will reduce the state's wealth by making it less attractive to the wealthy, who invest, spend and pay other taxes in the state.

Its critics include conservative voices, as well as Democratic Gov. Gavin Newsom and entrepreneurs such as Google co-founders Sergey Brin and Larry Page as well as PayPal's Peter Thiel. The latter has already moved his primary residence to Miami, showing concern about the new tax bill as well as broader Silicon Valley unease about overregulation in California.

Some of the figures who acquired properties and moved their businesses out of California include, according to a report from The New York Post:

- Larry Page, co-founder of Google: More than 45 of his liability companies linked to the entrepreneur have reportedly become inactive, while he has reportedly acquired two properties outside California.

- Sergey Brin, co-founder of Google: He is said to have been eyeing a property in Miami and dissolved or relocated 15 partnerships.

- David Sacks, administration cryptocurrency czar: The entrepreneur and founder of Craft Ventures announced his move to Austin, Texas.

- Lynsi Snyder, In N Out heiress: Relocated her family and opened a second corporate office in Tennessee. The food chain's parent company, however, will remain in California, according to Snyder.

All of them could be joined by Mark Zuckerberg. According to the The Los Angeles Times, the billionaire is contemplating buying a property in Florida. According to previous reports, it is a $200 million beachfront mansion. At the moment, neither he nor his representatives have commented on the possible move.

However, it could be too late for them. The text of the tax bill includes a provision that would apply the tax retroactively from the beginning of the year, thus taxing even those who have left the state since then.

Bernie Sanders, the big promoter of taxing the rich

Both Spielberg and Zuckerberg repeatedly donated to causes aligned with the Democratic Party, though Meta's CEO announced changes to his donation stream in recent times. Although Governor Newsom, a Democrat, opposes the measure (his team argues that high-income Californians already pay more taxes), others like Sen. Bernie Sanders support it.

"The billionaire class no longer sees itself as part of American society," he argued Wednesday from Los Angeles at the campaign launch in favor. "They’re saying there’s nothing you can do about it. Well, we’ve got some bad news for them, starting right here in California."

"These people suffer from an addiction problem. You know, we all know people sadly, we all know people addicted to drugs, addicted to alcohol, addicted to tobacco — face many serious addiction problems. But do you know what the most significant addiction crisis in America is today? It is the greed of the billionaire class," he argued.

Opponents of the proposal already filed several of their own to invalidate the new tax. One of them, filed nationally by Kevin Kiley (R-Calif.), seeks to prohibit states from imposing a retroactive taxes on assets of people who have ceased to reside within state borders.

"California’s proposed wealth tax is an unprecedented attempt to chase down people who have already left as a result of the state’s poor policies," Kiley noted. "No state should be allowed to reach back in time and impose a new tax on someone who no longer lives there. That is fundamentally unfair."