The 50/30/20 rule for Black Friday: learn how to manage your shopping dollars

Black Friday is one of the dates when consumers spend the most money in the run-up to Christmas. Here's how you can manage and limit your spending.

A store during Black Friday. File image

With Christmas approaching, consumers begin to shop for one of the most anticipated dates of each year. Many are aware of their economic limitations and, as a result, they scour websites and physical stores in search of the best deal, the one that will save them the most money.

Those great deals before the Christmas period come on specific days. For example, on Black Friday. This Nov. 28, stores make their discounted products available to the public, some with succulent discounts, to entice consumers to buy that thing they want so badly or that thing they want to give as a gift.

However, customers may overspend and spend more money than they can afford. To prevent this from happening, there are a series of recommendations to know how much you can spend on purchases depending on what you have, such as, for example, the 50/30/20 rule.

What is the 50/30/20 rule?

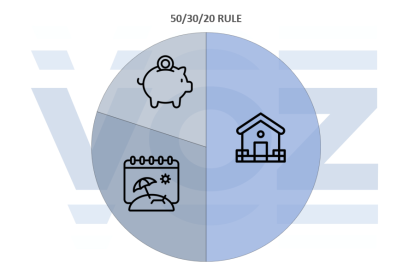

The 50/30/20 rule is a budgeting strategy that allocates an individual's net income, whether monthly or annual, into three distinct spending categories. This framework provides a structured way for people to manage their finances according to their needs, lifestyle, and savings objectives.

Each of these three categories are divided in this way:

- 50% for needs.

- 30% for wants.

- 20% for savings and/or investment.

50/30/20 rule

The list of "needs" includes everything that is essential for every human being: rent or mortgage, basic services (water, electricity, gas, internet...), food, clothing, transportation, medical insurance, medicines, debt payment....The idea is that these expenses should not exceed half of your net budget, whether monthly or yearly.

The "wants" category includes all non-essential spending on leisure and lifestyle, such as dining out, vacations, hobbies, and subscriptions. The key is to ensure these expenses do not exceed 30% of your net income.

Finally, the "savings" and "investment" category is for building your financial future. This includes building an emergency fund, saving for retirement, investing in property or your children's education, and making extra payments to pay down debt ahead of schedule.

Is it easy to calculate the 50/30/20 rule?

Yes and also easy to apply.

First, calculate your net monthly or annual income. Using that figure as your baseline, you can then split it into the three categories, starting with an assessment of your fixed expenses for "needs" before deciding what to allocate for "wants" like leisure and entertainment.

Subsequently, once you have classified your expenses, you can adjust them to get closer to the 50/30/20 rule, always prioritizing what you allocate to what is essential for you over what is a superfluous outlay or an investment for the future that you can postpone.

In short, the 50/30/20 rule is a practical tool for managing your finances. While not mandatory, it is a highly recommended framework for maintaining a healthy financial life and avoiding common complications.