Are foreign investors ready to trust Argentina? Javier Milei speaks with Larry Fink, the CEO of BlackRock, who will visit the country in May

“Total success,” is how the Argentine president described the meeting with the head of the largest investment fund in the world.

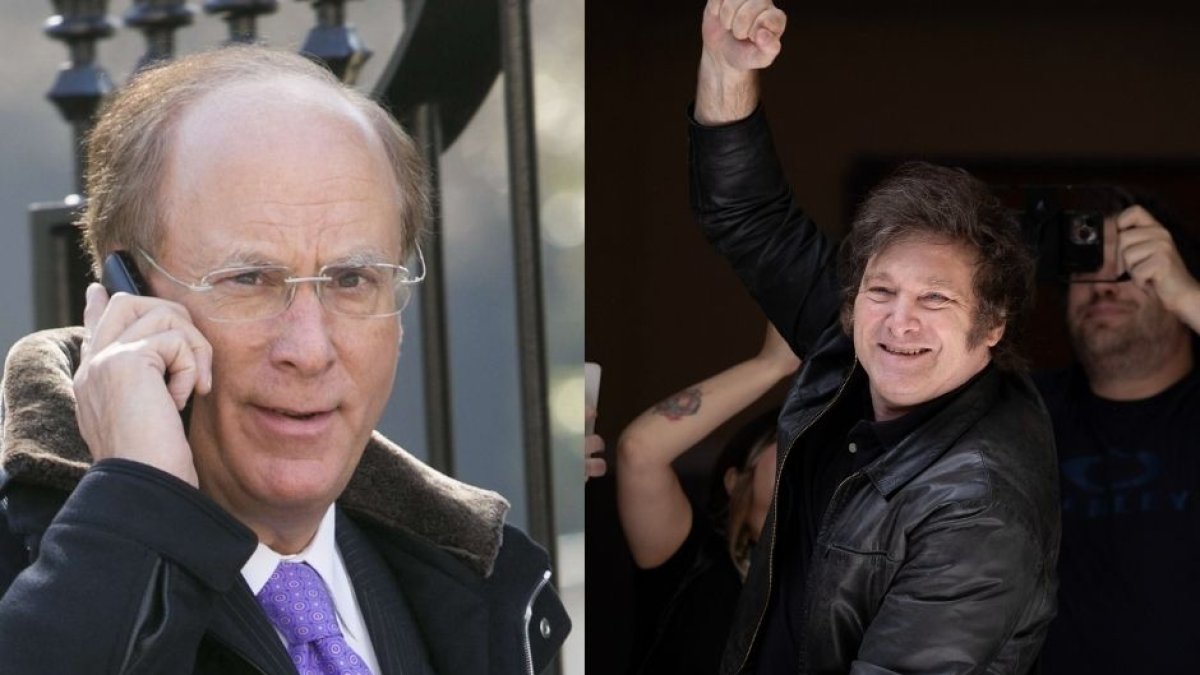

Larry Fink (i) y Javier Milei (d) / (Montaje Voz Media; fotos de Cordon Press)

The president of Argentina, Javier Milei, had a “successful” virtual meeting with Larry Fink, the CEO of BlackRock, the largest investment fund in the world.

"The president and Fink discussed the current and future outlook for Argentina. During the meeting, Fink also expressed his interest in evaluating infrastructure investment opportunities in the country in situ, which predicts a boost to current economic development," announced the office of the Argentine president.

According to the official statement, Fink promised that he will travel to Argentina in May to carry out potential investment projects. He will be received by President Milei himself and his team.

Gerardo Werthein, the new Argentine ambassador to the United States, also participated in the unexpected meeting, which took place at noon. The meeting occurred in the midst of the debate on the famous Omnibus Law in Congress and the publication of the details of the agreement between Argentina and the IMF.

The Argentine media reacted positively to the news, highlighting the importance of BlackRock's presence in the country and the return of good relations between the investment fund and the current government.

BlackRock, founded in 1988, is headquartered in New York and has 22 centers and more than 70 offices across 30 countries. It also has a strong presence in Argentina,since according to Bloomberg, the firm has more than $1.6 billion in twenty different bonds issued by the South American country.

In fact, BlackRock, in addition to buying Argentine debt securities, also owns shares of key Argentine companies such as Mercado Libre, Tenaris, Grupo Galicia, Banco Macro, Telecom, Pampa Energía, TGN, Arcos Dorados and Adecoagro, among others.

Milei's team expressed the intention to carry out projects with the investment firm that seeks, together with the government, to turn Argentina into a "logical" and "predictable" country, official spokesperson Manuel Adorni told reporters.

According to Forbes Argentina, BlackRock's support or the firm's intention to invest again in Argentina is a direct endorsement of the political project of Javier Milei, who seeks to liberalize the economy of one of the most regulated countries in the world through a mega program of deregulation, privatizations and also an austere fiscal policy.

In fact, the sheer investment interest of BlackRock, which manages some $10 trillion in assets, demonstrates that Milei's government is capable of attracting one of Wall Street's biggest players.

Likewise, Fink's imminent visit to Argentina is a sign that the head of the largest investment fund in the world no longer distrusts the South American country to take risks, as he had said in 2020, in the middle of the pandemic.

“Right now we have no confidence. What's more, I think it will take a long time for there to be private investments in Argentina again,” the CEO of BlackRock said at that time, at a conference organized by Banco Santander.

However, Fink himself had also clarified that there was a possibility of assuming risk in Argentina if the “government gives us back the confidence to invest again. Let's hope so."

It seems that that moment is now, with Javier Milei.