Towards double-dip recession: 70% probability of economic downturn by mid-2023

A report from RaboBank notes that "the Fed will need to drive the economy into recession" to end inflation.

(Pexels)

The economy appears to be coming out of the technical recession it experienced in the first half of this year. However, the Treasury yield curve remains inverted. This scenario suggests that the country could be facing two recessions: one with a technical character -already past-, and another with an official character, which although caused by the same factors, were interrupted by a positive growth in gross domestic income (GDI).

The unadmitted recession "is over."

Although the White House declined to use the term "recession," RaboBank reviews in a report that the economy was in a technical recession the first half of the year, with its first two quarters experiencing negative gross domestic product growth (-1.6% and -0.6%). However, GDI growth was positive in both quarters (0.8% and 0.1%), according to data published at the end of September.

GDP measures the value added of goods and services produced and GDI measures the income earned on this production - wages, profits, interest income and rental income. Although in theory, they should be the same because they measure the same production. In practice there may be discrepancies.

While GDP shows a recession, the GDI indicates a technical slowdown in the first half of 2022 attributed to positive labor market data. With employment remaining strong, the Federal Reserve Bank of Atlanta's real gross domestic product (GDP) growth rate for the third quarter forecasts 2.7% GDP growth, suggesting it may have turned positive in the second half of the year.

Road to a second recession

The economy is on track for a second recession next year, but this time declared by the National Bureau of Economic Research (NBER). The "underlying momentum" of the economy will disappear because of ongoing factors such as high, persistent inflation. The economic downturn, together with a tighter monetary policy, will be compounded by a decrease in corporate hiring, which will lead to a slowdown in employment growth, according to the RaboBank study:

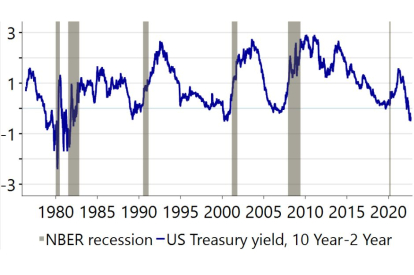

The inverted Treasury yield curve is considered a "harbinger of recession" the report reveals that "the Federal Reserve's hiking cycle" has led to a sharp rise in Treasury yields this year. The ten-year yield has risen to 3.83 from 1.63% at the beginning of January. However, the one that is more closely related to the Fed's rate policy has seen the largest increase. The two-year yield has gone from 0.76% at the beginning of January to 4.22 on September 30, so the yield curve has inverted in the 2-10 segment."

Recession approved by NBER

"The Fed will need to drive the economy into recession" to end inflation. "While GDP and GDI" are still disparate, "the Fed's hiking cycle and inverted yield curve point to an NBER-approved recession" in the second half of 2023. Both recessions (in 2022 and 2023) are linked "to negative supply shocks, elevated inflation and the Fed's policy response." The current inversion of the yield curve indicates a 70% probability of recession.