US firm leads race to challenge Chinese dominance in rare earth production

MP Materials is boosting rare earth production in the U.S. with Pentagon backing and a deal with Apple, challenging China's control over 90% of the magnets that are essential for technology and defense development.

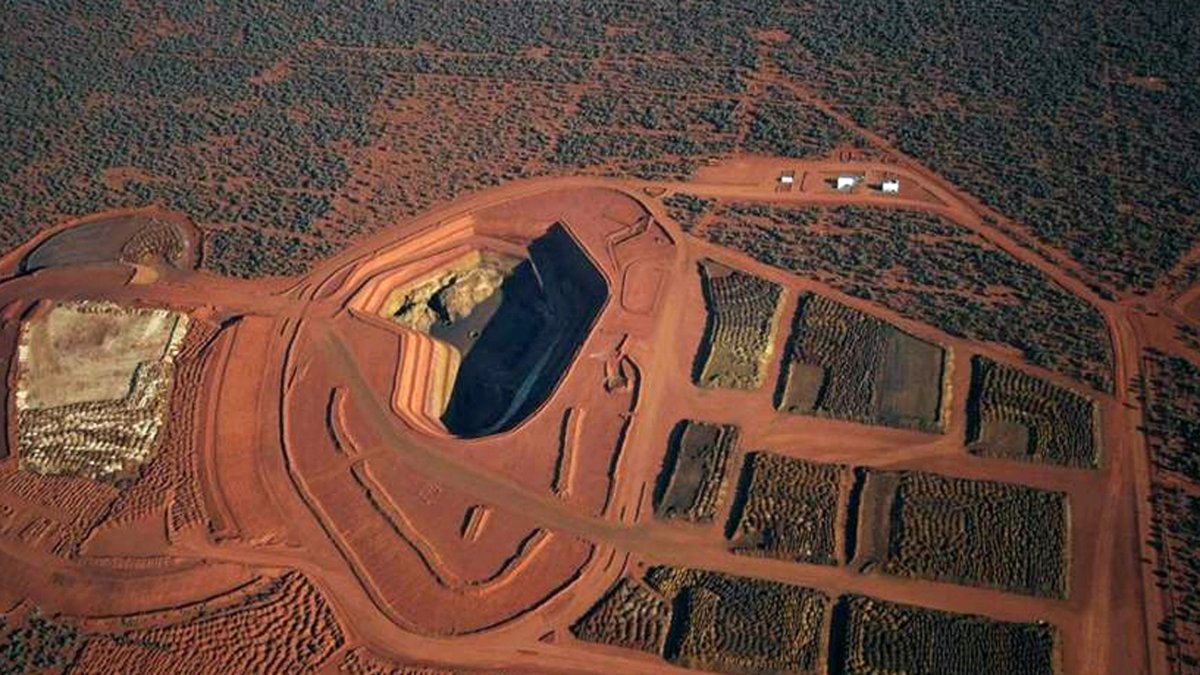

Rare earth reserve at a mine in Australia.

In the heart of Texas, MP Materials plant is working flat out to produce rare earths, key minerals for everything from smartphones to advanced weaponry. With a multibillion-dollar investment and the backing of the Pentagon, this company is leading the U.S. race to challenge China's control over 90% of China's production of rare earths, the key minerals for everything from smartphones to advanced weaponry, a monopoly that even keeps giants like over 90%="" of="" the="" magnets="" that="" power="" global="" technology="" and="" defense,="" a="" monopoly="" has="" put="" giants="" such="" as="" Ford over>and also Tesla in check.

China has consolidated its dominance through high-quality mines, cheap chemicals, and a skilled workforce. Its restrictions on magnet exports, requiring proof of no military ties, prompted the temporary closure of a Ford plant and sent prices soaring.

“We cannot get any high-power magnets without China”, admitted Jim Farley, chief executive of Ford, at an event at the end of June. This has led U.S. companies to pay up to 50% more for local magnets, according to industry sources.

Changing the game

MP Materials is changing the game. Its mine in Mountain Pass, California is the largest source of rare earths in the Western Hemisphere. This week, the company announced an agreement of $500 million with Apple to supply recycled magnets starting in 2027, while General Motors will receive deliveries by the end of 2025.

For Apple's part, CEO Tim Cook noted, “Rare earth materials are essential for making advanced technology, and this partnership will help strengthen the supply of these vital materials here in the United States.”

In addition, the Pentagon, who is now its major shareholder, will invest hundreds of millions to triple magnet production at the Fort Worth plant, dubbed "10x," from 1,000 to 10,000 metric tons annually. "The agreement marks a major step in rebuilding America’s domestic rare earth industry", said a spokesman for the White House, quoted by the Wall Street Journal.

The rebirth of an industry, a long road

The U.S. rare earth industry, rich in minerals such as neodymium and samarium, collapsed in the 1990s and 2000s in the face of Chinese competition, which flooded the market with unbeatable prices.

In 2015, the bankruptcy of Molycorp, then operator of the Mountain Pass mine, seemed to seal the fate of this sector. However, James Litinsky and Michael Rosenthal, founders of MP Materials, saw opportunity where others saw failure. "There was a belief that it couldn't be fixed," said Litinsky, CEO of MP. “I certainly didn’t know what I was getting myself into", added Rosenthal, chief operating officer.

When they acquired Mountain Pass in 2017, the mine was in ruins, with only eight workers, Rosenthal recalled. And, with no mining experience, they faced a colossal challenge: reactivating an industry the U.S. had lost.

Initially, MP relied on Shenghe Resources, a Chinese company, for financing, shipping minerals to China for refining.“We’ve got no money, we’ve got eight people, the site was bankrupt, everyone says", Rosenthal recalled of that time.

But with Pentagon grants of about $100 million, MP began to develop its own processing capacity.

By 2023, MP became the only U.S. company separating rare earths on a commercial scale, selling directly in the U.S., Japan and South Korea. This achievement marked a milestone: the US no longer relied exclusively on Chinese refineries. However, producing high-quality magnets was the next hurdle, one that required expertise that was almost nonexistent in the US.

Overcoming technical barriers

Making rare-earth magnets is a complex art, mastered by China thanks to techniques such as grain boundary diffusion (GBD), which reduces costs and improves quality. In the US, expertise in this field was scarce, with most experts retired.

MP turned to global talent, hiring Alan Lund, a metallurgist with expertise in high-performance alloys, to lead the project. In a lab nicknamed "the Garage," the company invested years in deciphering the science behind the magnets, developing a proprietary GBD formula that optimizes the use of expensive materials.

Challenges and criticisms

Despite advances, MP faces obstacles. Production costs in the U.S. are at least 50% higher than in China, and the company needs heavy rare earths, scarce outside Asia.

Chinese overproduction in 2022 plummeted global prices, affecting MP's profitability. In addition, some competitors criticize the government's heavy investment in MP, arguing that it could marginalize other startups such as Vulcan Elements or Noveon. “It’s the government picking winners and losers", said an executive at another company.

Nevertheless, MP is moving ahead, and to its critics it replies that “there’s going to be a lot of growth opportunities”, Litinsky said.

A great future

MP's deals and investments are well on track with respect to the future of this industry in the country. Along those lines, experts such as Gracelin Baskaran, director of the critical minerals security program at the Center for Strategic and International Studies, see MP as a pillar key: “essentially working at warp speed to address one of America’s greatest national and economic security challenges of our time.”

If current projects succeed, the U.S. could reduce its dependence on China in 3 to 5 years.

Key details of MP Materials' operation

Commercial agreements: A $500 million contract with Apple for recycled magnets (starting in 2027) and deliveries to General Motors by the end of 2025.

Pentagon support: Investment of hundreds of millions of dollars, guaranteeing a minimum price for minerals and magnet purchases, with a target of 10,000 metric tons annually.

Current capacity: MP is the only U.S. company separating rare earths on a commercial scale, selling within the U.S., but also outside in Japan and South Korea.

Good way: The company developed processes such as grain boundary diffusion (GBD) to reduce costs and improve magnet quality.