The IRS reverses one of its most controversial practices

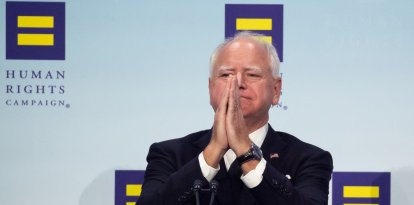

This was announced by the Commissioner of the Internal Revenue Service, Danny Werfel, who stated that this is a "step towards common sense."

IRS/Wikimedia Commons

The Internal Revenue Service (IRS) made an important announcement about its modus operandi. In an attempt to clarify its dealings with taxpayers and, according to the agency's commissioner, to move towards "common sense," they will suspend the policy of surprise visits.

The news was announced through a statement from the IRS itself, which listed the reasons that led them to make the decision and accompanied it with words from Danny Werfel, commissioner of the agency. "We are taking a fresh look at how the IRS operates to better serve taxpayers and the nation, and making this change is a common-sense step," he said.

"Changing this long-standing procedure will increase confidence in our tax administration work and improve overall safety for taxpayers and IRS employees," Werfel added.

They explained that the unannounced visits to homes and businesses posed risks to the officers themselves as they attempted to resolve issues with delinquent citizens.

"These visits created extra anxiety for taxpayers already wary of potential scam artists. At the same time, the uncertainty around what IRS employees faced when visiting these homes created stress for them as well. This is the right thing to do and the right time to end it," Werfel explained.

At the same time, the statement highlighted the increase in personnel they will experience in the coming years due to the effects of the Inflation Reduction Act, enacted by the Biden Administration in mid-2022. This will add collection capacity to the IRS without resorting to the aforementioned surprise visits.

"We have the tools we need to successfully collect revenue without adding stress with unannounced visits. The only losers with this change in policy are scammers posing as the IRS," concluded Werfel.

A letter will replace surprise visits

The Internal Revenue Service quickly decided on a replacement for unannounced visits to taxpayers: an appointment letter known as a 725-B, through which a follow-up order is scheduled. In other words, face-to-face meetings between the taxpayer and the IRS representative will now be scheduled.

However, the press release clarified that surprise visits are not extinct and will only occur in very specific cases. "There will still be extremely limited situations where unannounced visits will occur. These rare instances include service of summonses and subpoenas; and also sensitive enforcement activities involving seizure of assets, especially those at risk of being placed beyond the reach of the government. To put this in perspective, these types of situations typically number less than a few hundred each year – a small fraction compared to the tens of thousands of unannounced visits that typically occurred annually under the old policy," they wrote.