Dozens of attorney generals ask banks not to adopt ESG scoring systems

The letter warns that using the social criteria could be considered a breach of its legal obligations.

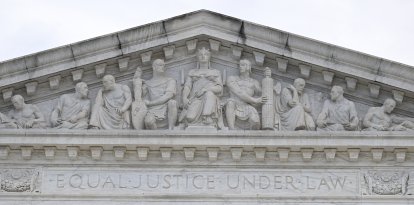

(Wikimedia Commons).

Two dozen attorneys general signed a letter warning the country's largest banks that if they adopt ESG (Environmental, Social and Governance) policies, it could be considered a breach of their legal obligations to their customers.

The letter was an effort led by Montana Attorney General Austin Knudsen and was signed by Republican prosecutors from 21 states - Alabama, Arkansas, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, New Hampshire, Ohio, South Carolina, Tennessee, Texas, Utah, Virginia, West Virginia and Wyoming.

In the text, the attorneys emphasized that financial entities must comply with general and state laws. "Simply put, you are not the same as political or social activists and you should not be allowing the vast savings entrusted to you to be commandeered by activists to advance non-financial goals," the letter stated as reported by Fox News.

A "flagrantly illegal" system

In an interview, prosecutor Knudsen spoke openly about how dangerous he finds these social criteria. "This ESG nonsense is filtering into a lot of our states and the way they're doing it is really, really concerning and probably flagrantly illegal. Pushing it through these asset managers and through these proxy votes is extremely concerning," he said.

ESG approach contributed to Silicon Valley Bank's collapse

During the month of March, several attorney generals warned that the use of these social criteria that are part of a radical leftist agenda could be counterproductive.

In fact, prosecutors claimed that the ESG may have contributed to the collapse of Silicon Valley Bank (SVB). "SVB’s failure is a warning sign that the administration’s environmental activism in its financial regulation not only ignores real financial risk but increases it. The administration should refocus regulation on true risk and stop pressuring financial institutions to meet impossible net-zero targets," warned Sean Reyes, Utah's attorney general.

"To put it bluntly, the administration’s zealotry in fighting climate change by unwisely—and illegally—attempting to convert federal financial regulators into environmental activists is inextricably intertwined with these bank failures and the fallout from them," stated the letter from the Republican prosecutors.