The 21st Century Will NOT Be Chinese

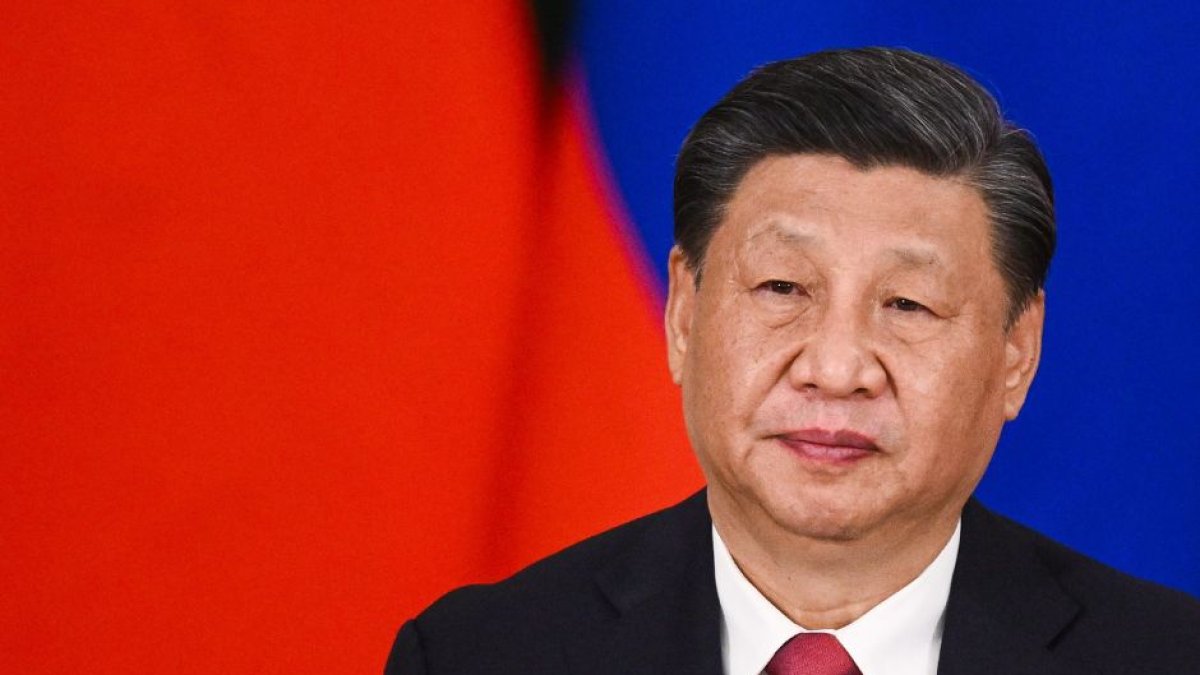

Xi can see that his "window of opportunity" -- during a Biden administration that is possibly compromised -- is closing. What lies ahead for China looks like stagnation at best.

(Cordon Press)

Hardly anyone cares, because it all seems so far away during the summer, but the news of the week is most likely the crash of China. Real estate, currency, stock markets, technology, demographics: it all fits together, and what lies ahead for China looks like stagnation at best.

1. Housing Market Meltdown

The crash of the Chinese housing market: There are an estimated 80 million unoccupied homes in China -- a huge number, even for a giant country. While real estate has driven China's growth for decades, it is now in danger of wrecking it. The major Chinese property development conglomerates are going bankrupt one after the other. There is no fix or solution that will artificially revive China's "bricks" this time. For years, the Chinese regime artificially stimulated real estate as an economic engine -- and it worked! -- but sometimes there comes a glut, and in China, that glut is now.

2. Collapse of the Yuan

Then came the marginalization of the Chinese currency, the yuan, presented as destined to replace the dollar. Not quite yet. The yuan may or may not be weak, but above all no one wants it as an international currency because no one trusts the reliability of the Chinese regime in the long run. No one wants to buy Chinese bonds. "It is very hard to create a reserve currency, without attractive reserve assets. China has a problem. It wants foreigners to buy bonds but they have been selling since early 2022," Jens Nordvig, founder and CEO of Exante Data, recently noted.

When big Chinese companies borrow on the international markets, it is always in euro-dollars (an iteration of the dollar), and certainly not in yuan.

The yuan, whether it is weak or not, will not replace the dollar, not even in South-East Asia. While the recent strengthening of BRICS (the informal group comprising Brazil, Russia, India, China, and South Africa ) is an interesting geopolitical development, there is no indication at this stage that the other BRICS members are ready to adopt the yuan in their transactions -- and certainly not India.

Regarding the concept of a dedicated currency for BRICS nations, experts have expressed their skepticism. Danny Bradlow, a faculty member at the Centre for Advancement of Scholarship at the University of Pretoria in South Africa, cast doubt on the practicality of reverting to the gold standard -- there is not enough of it if everyone wanted it a redemption -- or using cryptocurrencies. He questioned their reliability in global trade. There are serious investors who regard cryptocurrencies as essentially a conceit, like the 17th century's Dutch tulip mania. Even then, at least you had a tulip bulb.

Discussing the complexities of establishing a BRICS-specific currency, Shirley Ze Yu, a senior visiting fellow at the London School of Economics, mentioned that forming such a currency would necessitate creating a range of institutions with shared standards and values. "These are very difficult to achieve, although not impossible," she noted.

Chris Weafer, an investment analyst specializing in Russia and Eurasia at Macro-Advisory, labeled the proposition of a BRICS currency a "non-starter."

3. The Chinese Stock Market Collapse

It is likely that Chinese Communist Party Chairman Xi Jinping does not really understand how markets work. He may have thought he could multiply his arbitrary interventions in the Chinese stock market without any consequences. There might, however, be at least one consequence: a loss of confidence. Why would anyone want to invest in a stock market that is constantly at the mercy of a communist 'Prince' and his subjective whims and predilections?

According to China's new "Anti-Sanctions Law," just about anything can be a crime, and one's assets seized if the Communist Party leaders want them to be. The raid on the Shanghai headquarters of Bain & Company and the colonization (seizure) of the Hong Kong financial center by China's imperialists also had the effect, from a strictly financial point of view, of emptying the Chinese market of all reliability.

There is also the problem that in China there are no private companies: under the Chinese Communist Party's notion of "civil-military fusion," all companies belong to the central government and can be raided for information at any time.

4. Lack of Technological Innovation

China's belligerent radicalization has led the United States, despite decades of good relations with China, -- such as China's failure to comply with US transparency or accounting standards; trade deficits always in China's favor, permanent and systemic Chinese theft of American intellectual property -- to question its "sharing" of semiconductor technology with China. The Chinese government does not seem to have mastered this field yet, possibly making Xi even more interested in seizing Taiwan, which is a global center for computer chips. Chinese companies and the government may fear lagging behind companies from Japan, South Korea, Taiwan and the West -- and this is one of the few points of convergence in the US between Republicans and Democrats.

5. Demographic Collapse

In every industrialized country and on every continent, with a few rare exceptions, demographic curves are collapsing. Above all it is true of China, which, with a fertility rate of 1.28 children per woman, seems destined to follow in the footsteps of Japan. Xi appears to be trying to reverse this downward trend, but has only succeeded in accelerating it. Despite the formal termination of China's one-child policy in 2016 and the introduction of financial benefits and tax reductions for families, birthrates have not seen a significant increase.

United Nations data indicates that while there was a minor uptick in the country's fertility rate shortly after the policy change, it has since declined. The numbers went from approximately 1.7 children per woman—similar to rates in Australia and the UK — to 1.28, one of the lowest globally. This recent decline mirrors an amalgamation of various societal and economic pressures that have accumulated in China over the years, but a dwindling labor force diminishes the potential for growth.

From the above, a prognosis: Our contemporaries often forget that the Chinese regime is not the equivalent of a British, American or Dutch democracy. The Chinese regime is a dictatorship in the strict sense, the dictatorship of a single party, and ultimately of a single man, Xi. So, if you want to overthrow a dictator, you can only do so by force, or if he decides to leave, or if his life comes to an end.

Xi, despite the failure of his economic policies, will probably not decide to leave. He might be hoping that the upcoming presidential election in Taiwan on January 13, 2024 will drop the country into his lap. To attract more international trade, he might postpone any planned aggression or, conversely, as tyrants often do, escalate hostilities to distract his own public from his economic crisis -- not as a prelude to the "Chinese century'", but as a desperate maneuver by a desperate man.

Xi has already told his military to "prepare for war" and "fight and win" it. He has flown spy balloons over America's most sensitive military sites and sent "hundreds of military-age Chinese men" into the United States through its open southern border -- presumably to disrupt a US counter-offensive should he invade Taiwan -- to sabotage American airports, electric grids, communications systems, water supplies, bridges, ports, highways, tunnels, and other strategic infrastructure.

Xi can see that his "window of opportunity" -- during a Biden administration that is possibly compromised -- is closing, and that the US is being led by a president who shakes hands with the air; says "No comment," about a town incinerated in Hawaii, and assures Russian President Vladimir Putin that a "minor incursion" into Ukraine would be fine.

Xi clearly saw the Biden administration flee from Afghanistan; eliminate energy independence and promote windmills; allow a spy balloon to complete its mission over sensitive US military sites; cancel the China Initiative that was thwarting research and industry theft; permit TikTok, Confucius Institutes, K-12 Confucius Classrooms, illegal Chinese "police stations"; let China buy American farmland, often near US military bases, and do virtually nothing to stop US investment in the Chinese industry and military by enormous public federal retirement accounts such as Thrift, as well as investments by the private sector.

Larry Fink, Chairman of Blackrock, urged investors to "triple their allocations in Chinese assets." "[W]e are one of 16 asset managers currently offering US index funds investing in Chinese companies," BlackRock told CNN about a country that is using them to displace America and rule the world.

Jamie Dimon, CEO of J.P. Morgan Chase, said that "he intends to operate in China according to US foreign policy and will plainly stop expansion if US policy dictates." In other words, investing in the Communist China, a country that openly wants to supplant America as the world's leading superpower to rule the world, is not illegal. If China attacks Taiwan and starts a war, it is the US that is funding it.

The military alliances organized in the region by the Americans also bear witness to the likelihood of the outbreak of war -- and its urgency.