Americans pay more in taxes than they do on food and health care

Inflation causes spending on consumer goods to increase in 2021. Health, food and clothing account for 23.1% of expenses.

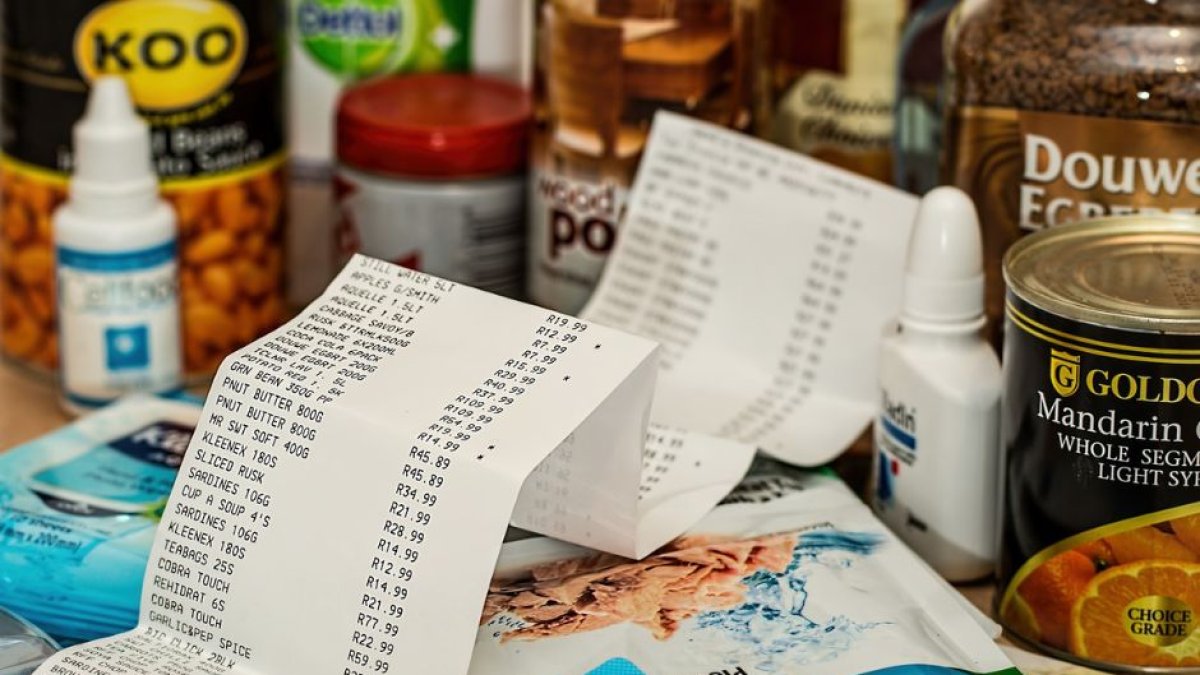

(Pixabay)

According to the Bureau of Labor Statistics (BLS), in 2021 each consumer unit (families, couples or single individuals) paid an average of $16,729.73 in federal, state and local taxes and $15,495.28 on food, clothing and healthcare. In other words, they spent $1,234.45 more on average on taxation at all levels, than on their personal expenses.

Money spent by Americans on personal expenses rose by $1,567.54 ($13,927.74 in 2020). This increase is linked to the rise in inflation. Rising prices meant that each consumer unit spent more money on food, clothing and healthcare.

If in 2020, $7,316.47 was spent on food, the following year each consumption unit spent $8,289.28. In addition to this, more money was also spent on clothing ($1,754.39 in 2021, up from $1,434.26 in 2020) and health ($5,451.61 in 2021, up from $5,177.01 in 2020).

Food expenses account for 12.4% of expenditures. Clothing accounts for 2.6%, and healthcare spending for 8.1%. In other words, these three categories account for 23.1% of average household expenditures.

Tax expenditure

Federal income taxes had a slight decrease between 2020 and 2021. If $8,561.46 was spent on this levy last year, in 2020 each consumer unit paid $8,811.78 in federal income taxes. In contrast, state or local income taxes increased by $134.43 ($2,564.14 in 2021 from $2,429.71 in 2020).

On the other hand, Social Security and property taxes also went up in 2021. A consumer unit shelled out $173.10 more in Social Security fees in 2021 ($5,565.45 to $5,392.35 in 2020). Property tax payments also increased, by $121.76 ($2,475.18 in 2021 for $2,353.42 in 2020). Regarding other taxes, each family unit spent $105.21 in 2021, up from $71.87 in 2020.