Bidenomics: Student debt to return to current levels in less than 10 years

Biden's forgiveness plan does nothing to reduce the amount of loans in the future, which would cause further cancellation.

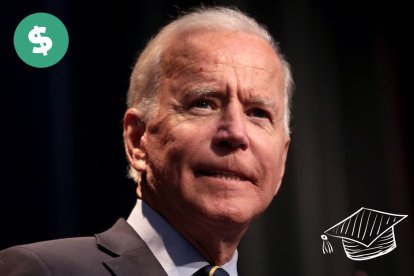

(Voz Media / Cordon Press)

A new report from the Committee for a Responsible Federal Budget(CRFB) estimates that student debt will reach pre-Biden cancellation levels in less than a decade due among several factors to inflation. Experts say that the Administration's forgiveness plan will not be useful in the long term. According to the CRFB:

Biden's plan also does nothing to reduce the amount of borrowing in the future, preparing an incoming Administration to pay down the debt again.

It is estimated that the cancellation of loan repayments will cost taxpayers approximately half a trillion dollars. The $10,000 per borrower and $20,000 forgiveness for Pell Grant recipients will cost the Administration between $440 billion and $600 billion.

Criticism of the plan

CRFB is not alone in pointing to Biden's plan as a failure. Several economists have warned about how debt cancellation will increase inflation. One of the Obama Administration's top economists, Jason Furman, said the cost of loan forgiveness will be felt in the economy by all Americans:

Furman also called the plan "imprudent" and said it will be "gasoline on the inflationary fire".

Most Americans feel the same way. The Center Square in an NBC/Momentive poll showed that 59% of Americans are concerned that student debt cancellation will increase inflation.

Those who benefit the most

A JPMorgan study concluded that up to 34% of all debt can be cancelled, or $549 billion, out of a total of $1.62 trillion in outstanding federal debt.

Households with higher incomes-over $116,000-would receive more debt forgiveness money, compared to households with lower incomes-less than $34,000. The approximate difference is about 8 percentage points of benefit to higher incomes.

In terms of ethnicity or race, whites benefit the most from the amount of money granted for forgiveness (49%), followed by blacks (29%) and Hispanics (21%). On the other hand, middle-class black households will be 2.5 times more forgiven than an average white household, as they have more student debt relative to their percentage of the population.

JPMorgan used Chase Bank and credit bureau administrative data on 200,000 student debt holders to estimate how the benefits of this cancellation program might be distributed based on household income and borrower race.

The Biden Administration, on the other hand, claims that the reforms would be an important step towards significant savings for low- and middle-income borrowers: "A number of independent analyses have broadly agreed that our debt relief plan is targeted at low- and middle-income individuals." said a White House spokesman to the Wall Street Journal.

RECOMMENDATION