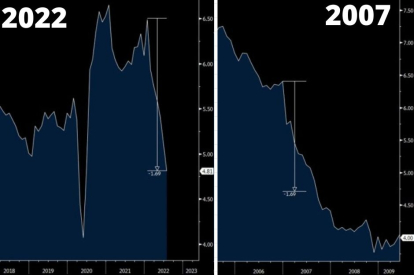

The rate of decline in home sales is unprecedented

In 2007, during the great recession, the fall of the real estate sector was not as severe.

Bloque de apartamentos / Pixabay

Existing home sales continue to fall in the worst drop in history, reaching a seven year low outside of Covid-19. There has been a decline of approximately 1.7 million home sales in just the last six months.

The housing bubble peaked in 2005 and then collapsed in 2006, but the speed of the decline did not accelerate until it came crashing down in 2007. However, the current pace of decline is unprecedented. The drop in home sales in the first few months was so steep that it cannot even be matched to the slowdown during 2007 where it took nine months to match the speed of decline that occurred in just six months in 2022.

It could get worse

The Conference Board's Leading Economic Index declined by 0.4% in July of this year. This indicates a plunge to 0% from its 2021 peak. If it officially falls into negative territory in August, it could be a warning of a housing recession.

On 12 previous occasions since 1960, the LEI has fallen below 0%. 66% of those times it was an early warning of a coming recession. Only on four occasions did a recession not occur and the coveted soft landing was achieved: in 1967, 1996, 1999 and 2016. According to Christopher Puplava, Director of Finance at Financial Sense, what all these soft downturns have in common is that the LEI was only slightly below 0%. However, when it falls to -1% or more, there is always a recession.

Given the pace of the current decline, and with inflation at a 40-year high, the -1% threshold will likely be breached this month, and unless inflation disappears or falls below 3%, a soft landing would be very difficult to achieve.

Prices may fall

Projections point out that between the housing market cooling off, plus forecasts of a recession could lead to prices falling by as much as 15%. In a statement, Fitch Ratings said that in the event of a decrease of approximately 30% or more in real estate activity in the next few years, prices would plummet between 10% and 15%. The report also revealed that average U.S. home prices would fall "at single-digit mid-to-high percentages annually."

The agency noted that factors such as U.S. Gross Domestic Product (GDP), unemployment, consumer confidence and housing affordability will be key indicators in determining the health of the housing market in the near term.