IRS to hire agents "willing to use lethal weapons"

Janet Yellen says not to increase pressure on the middle class, but there is no law against it.

(Min Lee/Flickr)

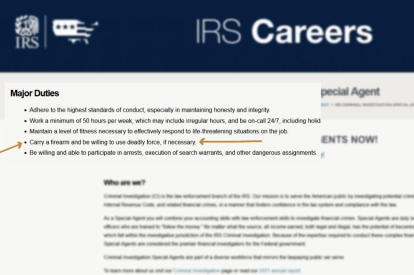

The IRS (Internal Revenue Service) has created job vacancies for which it requires"carrying a firearm and a willingness to use deadly force, if necessary". This employment would be part of the enormous $80 billion expansion of the inflation reduction law for the agency. These huge funds will be used to hire 87,000 more agents to its services.

IRS asks for special agents

On its jobs page there is a list of vacancies for special agents who can be distributed throughout the country to eradicate financial fraud. The curious thing is that these agents are more than just financial experts: they will also be armed.

IRS careers

Among the requirements for the job listed: Carry a firearm and be willing to use deadly force, if necessary. They also have to work a minimum of 50 hours and be on call 24 hours a day. They should also look good. And all this, for a salary of between $50,704 and $89,636 and 24 days off per year.

As described by the IRS. They are financial analysts and armed agents ready for a shootout:

Criticism of the inflation reduction law

Secretary of the Treasury, Janet Yellen said to Internal Revenue Service that if the Inflation Reduction Act becomes law, additional IRS resources should not be used to increase audit fees for taxpayers earning less than $400,000 per year. The IRS reports to the Treasury Department.

Yellen stated in a letter released by the Treasury Department, that any new IRS staff “will not be used to increase the proportion of small businesses or households below the $400,000 threshold that are audited relative to historical levels."

The bill, which has already passed the Senate without Republican support, increases the IRS budget by about $80 billion over 10 years. Democrats claim that the new budget for the IRS will increase tax collections and help pay for the $430 billion bill, which addresses climate change and reduces prescription drug costs for seniors, among other things.

For their part, Republicans have criticized the additional funding for the IRS, claiming that the agency will not only target the wealthiest taxpayers, but will also go after middle-class families. Sen. Ted Cruz (R-Texas) has been especially critical of this, "Democrats are making the IRS bigger than the Pentagon, the State Department, the FBI, and the Border Patrol combined." "Those IRS agents are designed to go after you," not to "go after billionaires and big business."

"The law will affect the poorest."

According to David Harsanyi of The Fereralist, "The bill is going to be the largest expansion of the national police state in U.S. history." Harsanyi states that do not believe the democrats since "most law-abiding citizens know that they have something to fear from a state agency, which has no regard for their privacy and is empowered to persecute anyone it wants without any genuine oversight."

He also calls it "nonsense" for the IRS expansion to focus exclusively on high-income earners:

White House press secretary Karine Jean-Pierre promised that the IRS would not conduct new audits of anyone earning less than $400,000, a claim she has no authority to make and could not predict, although the had.... Nothing in the bill that Democrats passed in the Senate limits audits. All Senate Democrats voted against a Republican amendment that would have prevented the new agents from auditing individuals and small businesses with less than $400,000 in taxable income.

It is also noted in the analysis that the most affected will be poor and middle-class Americans because "they are much more likely to do their own taxes, and therefore more likely to make mistakes." In 2021, those earning $25,000 or less, often the young and elderly, were audited at five times the rate of others. "The richer you are, the more likely you can hire lawyers and accountants to work within the system. There are not enough millionaires and billionaires in the world to keep a possible 87,000 new IRS employees busy."

Partisan use of the IRS

In 2013, under the Barack Obama Administration, it came to light how the IRS had singled out members or supporters of conservative political groups for intense scrutiny based on their names or political issues. In other words, the IRS carried out a tax harassment of organizations opposed to the federal government and used the information obtained to launch a second attack against them. This led to a condemnation by the agency and triggered several investigations. Conservatives claimed that the IRS was targeting them, and that they suffered continuous harassment.

This is not the first time the IRS has been controversial. A report released by the Treasury Department's inspector general in 2017 found that, between 2004 and 2013, the IRS used both conservative and progressive code words to choose targets for further study or scrutiny.

Confidence in the institution has been shattered at various points in history by scandals. However, the House of Representatives is expected to vote on the bill next Friday that will give it $80 billion. President Joe Biden has said he will sign it into law.