More than half of the households have economic difficulties due to inflation

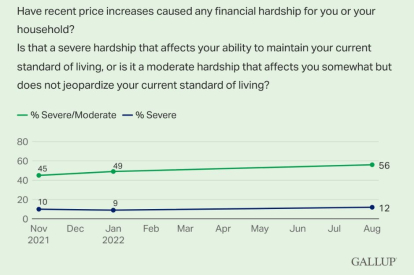

The percentage of families facing "severe hardship" is up three points to 12% so far this year.

(Pixabay)

Concern about rising inflation continues to grow among the population. The hardships faced by U.S. citizens, cause them to cut back on spending or, even worse, consume their savings.

According to an August Gallup 56% of Americans say they are suffering complications due to rising prices. So far this year, the situation has worsened: in January, 49% acknowledged having financial problems.

As for the severity of the difficulties they are experiencing, 12% consider them to be severe, compared to 44% who acknowledge having moderate difficulties.

Less income, more difficulties

With respect to the income level of each family, the lower the income level, the greater the severity of their personal situation. Twenty-six percent of households with incomes of less than $48,000 say they are severely hurt by rising prices. In comparison, 12% of middle-income and 4% of high-income Americans say they are more likely to experience hardship.

Of the lowest income earners, 74% say they experience some degree of financial hardship; four points higher than in the November survey. In the case of middle-income earners, it is 63%, and in the case of high-income earners, it is 40%. However, the middle class is the one that has worsened the most in recent months: in November, 46% had some difficulty; that was 17 percentage points less.

By political ideology

There is a clear difference between the ratio of Republican and Democratic families in terms of economic hardship. Forty-four percent of those close to Joe Biden's party recognize the complications they are suffering due to inflation, while 67% of Republican families confirm their economic problems.

The percentage of those families who consider themselves politically independent is established between both sides, with 56%.

Proposals and intuitions

Inflation in the country continues at very high levels. While the year-on-year ratio stood at 9.1%, in July it fell slightly to 8.5%. The Biden Administration is going to spend $740 billion to try to reduce inflation without lowering prices. Despite the attempt to control this economic scale, experts believe that it will not be effective and will take years to be reduced.

The New York Federal Reserve estimated that it will take several years to bring inflation under control. Its president, John Williams, was cautiously optimistic:

On the other hand, Cleveland Fed President Loretta J. Mester predicted a decline in inflation to 5% before the end of the year, while suggesting a rise in interest rates to 4%.

RECOMMENDATION