Rising rent prices suffocate families

Young people are the hardest hit: they pay 16% more in rent than the previous year. Rents will continue to rise until 2023.

(Wikimedia Commons)

Rental prices continue to rise at the fastest pace in decades. According to a new report from the Bank of America Institute, the average rental payment for its customers increased in price by 7.4% in July from a year earlier. The groups of people most affected by the rise in rent are middle-income households and younger generations.

According to the report, approximately 34% of households are renters, but that figure is even higher for low- and middle-income families. More than half, 53% of households with household incomes below the national average of $31,000 are renters.

The most affected

Households in general spend about 7% of their annual expenses on rent. Meanwhile, households without a college degree will allocate nearly 10% of their total spending to rent in 2020, the research notes.

For consumers with an annual household income between $51,000 and $100,000, the average rent payment jumped even more, up 8.3% from a year earlier in July. The lowest income group, earning $50,000 or less, experienced a 7.4% increase. Households earning more than $251,000 experienced the smallest annual increase, 5.9%.

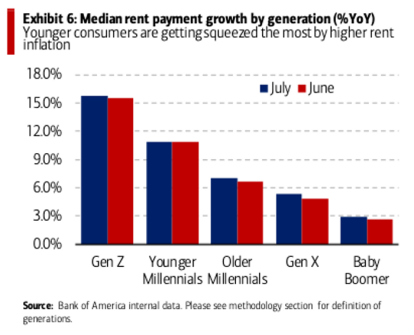

When talking about ages, younger consumers are the hardest hit by rising rent inflation, as the average rental payment for Generation Z increased 16% in July compared to a year earlier. Generation Z refers to those born after 1996. Meanwhile, average rental payments rose only 3% for Baby Boomers.

rent increases by generation

Cities with higher prices

Zumper's National Rental Report noted that the average cost for a one-bedroom rental rose to $1,450 in July, up 11.3% in 2021. Two-bedroom rentals reached $1,750 this month, up 9.3% from July 2001. And 15 of the 100 cities surveyed in the report have seen rent rise by 25% or more over the past year.

The record price increase is held by New York with 41% over the previous year. Miami follows with an increase of approximately 41%. Tampa with a 38% increase. Chicago and Nashville with price growth of 36%. While Los Angeles and San Francisco hover around 14% to 20%. North Carolina showed a 31% increase over July of last year.

No decrease in inflation

According to a Brookings Institution report: housing accounts for about one-third of the value of the market basket of goods and services that the Bureau of Labor Statistics (BLS) uses to track inflation in the Consumer Price Index. The increase in housing prices contributed to the rise in inflation in early 2022.

New forecasts from the Federal Reserve Bank of Dallas show that rental inflation is likely to continue rising to peak in mid-2023. The Dallas Fed's projections indicate that rental prices could increase by up to 8.3%. Rents are expected to remain elevated well above pre-pandemic levels throughout 2023.

The study Bank of America Institute predicts that despite the slight decline in headline inflation, which was largely attributed to lower gasoline prices, the cost of commodities such as rent and food continued to rise in the month of July and, there is no indication that rental inflation will slow down in the coming months.

RECOMMENDATION